It takes a big man to admit when he’s wrong.

But at least Reserve Bank Governor Philip Lowe was able to do that this week.

For the past two years since interest rates were dropped to 0.1%, he’s constantly assured us that rates wouldn’t go up until 2024.

I for one never believed it because since late 2020, inflationary red flags have been surfacing like teenage acne.

The problem is, his rhetoric has lulled waves of borrowers into a false sense of security thinking rates wouldn’t go up for ‘years’.

It was reckless at best.

But now we have a potentially bigger problem.

Instead of tapping the breaks on interest rates last year, the RBA (and the US Federal Reserve) may end up slamming them this year.

You see, the latest trading of bank bill futures suggests the RBA cash rate could be 4% by early 2023 due to inflation. It’s currently 0.35%.

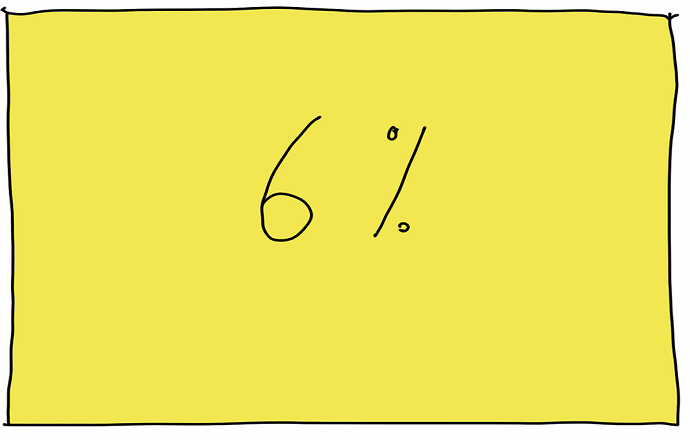

If that happens, mortgage rates will go to 6%.

Do I think this will happen?

I hope not!

It will hand break the property market, spike mortgage defaults, and hike us straight into a recession.

But I can tell you this much…

For the past eighteen months, I’ve been watching the bond market as closely as I’ve been watching the stock market and if my read on both is correct, what’s coming is not nice.

That’s how much things changed this week.

And that’s something I don’t like to admit.

Happy Mother’s Day!

Adam

In the past 12 months, CBA’s share price has climbed from $127 to $191 — a 50% gain. Impressive, right? And you’re probably thinking… “I should’ve bought some.” Not so fast, tiger. According to Morningstar — one of Australia’s most respected research houses — CBA’s fair value is closer to $90. That suggests it’s trading …

When you’re in your 20s, it’s easy to think that financial planning is something for the future, something to worry about when you’re older, have a family, or are closer to retirement. But the truth is, working with a Financial Planner early on can be one of the smartest decisions you ever make. At Suncow …

Continue reading “4 Reasons You Need a Financial Planner in Your 20s”

A financial plan isn’t just for the wealthy or nearing-retirement crowd. Whether you’re in your 20s and just starting out, or in your 50s thinking about retirement planning, a well-structured financial plan can give you clarity, control, and peace of mind about your money. At Suncow Wealth, we believe in empowering everyday Australians to take …

Continue reading “How to Build Your Personal Financial Plan”

Information provided by Suncow Wealth is general in nature and does not take into consideration your personal financial situation. It is for educational purposes only and does not constitute formal financial advice. Remember, the value of any investment can go down as well as up. Before acting, you should consider seeking independent personal financial advice that is tailored to your needs. Suncow Wealth Pty Ltd is a Corporate Representative No.441116 of AFSL 342766.